Market Review

Cheerful for the Holidays

Markets rallied in November giving investors plenty for which to be thankful.

November 2023

Key Observations

- Longer dated interest rates experienced a significant decline as market sentiment leaned towards anticipating 2024 rate cuts.

- Overall, markets showed positivity, driven by heightened risk appetites fueled by the decrease in rates and a less hawkish central bank.

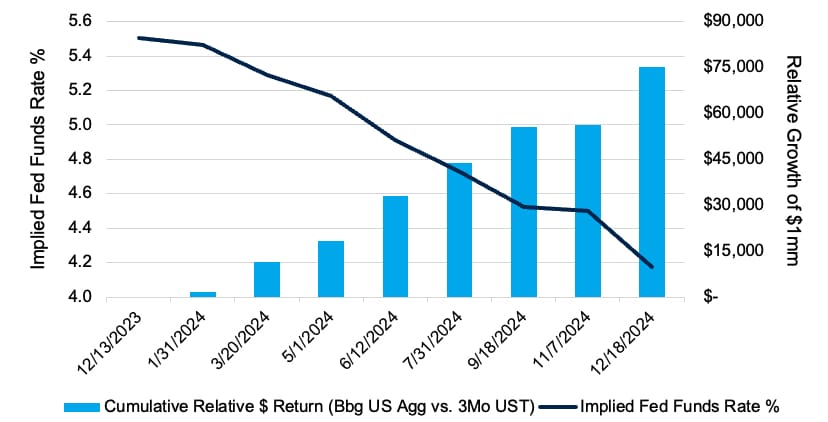

- Investors holding excess cash may face opportunity costs if anticipated rate cuts materialize in 2024.

Market Recap

Interest

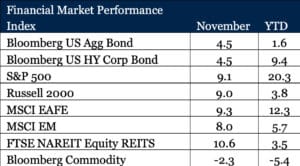

Bond prices surged as rates fell across the curve and the Bloomberg U.S. Aggregate Bond Index recorded its best monthly return in 30 years. Expectations of a rate hike pause and moderating inflation alleviated pressure on rates. Notably, November marked the first month since May of this year that fixed income markets broke a streak of monthly declines. Across various fixed income sectors, returns outpaced Treasuries on a duration-adjusted basis, propelled by tightening credit spreads and an increased risk appetite amid favorable fundamentals. This trend is evident in the year-to-date returns of U.S. High Yield Corporate Bonds, which have surpassed other segments within the fixed income markets.

Global equity markets experienced a notable rebound in November. In addition to the Federal Reserve’s shift in tone and the positive economic data trends mentioned earlier, robust earnings growth in the third quarter played a crucial role in driving market momentum and revitalizing investor interest. The S&P 500 Index posted a substantial return of 9.1% for the month. The “Magnificent Seven,” comprising major technology giants Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla, demonstrated strong performance during the month, with all members except Alphabet (+6.9%) and Meta (+8.6%) outperforming the S&P 500 index. However, all constituents of the Magnificent Seven have delivered eye-popping returns year-to-date, ranging from +46 to +220%. Despite lagging year-to-date, small caps rose as investors continued to assess the probability of a soft landing and a Fed pause.

International markets mirrored the positive sentiment, aligning with domestic markets for the month, buoyed by U.S. Dollar weakness. China continues to weigh on emerging markets, which lagged developed markets in the month despite posting a positive absolute return. Deflationary concerns, weakness in the real estate market, an underwhelming reopening from COVID-19 restrictions, and subpar economic activity have contributed to poor sentiment for the country.

Real Estate Investment Trusts (REITs) experienced a rally in the month, aligning with the positive performance of equity counterparts and managing to enter positive territory year-to-date, despite challenges in the commercial real estate sector. The overall strength was bolstered by a declining interest rate environment, with data centers standing out as top performers, driven by a positive outlook for Artificial Intelligence (AI).

Commodities were the only asset class to struggle during the month, driven primarily by a declining energy sector. The decline in oil prices played a significant role in weakening returns, as concerns grew regarding a potential slowdown in global demand for the commodity. However, at the end of November, OPEC+ announced upcoming production cuts slated for 2024 to support prices, providing a potential positive turn for the sector.

Are You Prepared for the Final Descent?

One

Readers of our monthly review series know that we have been advocating for duration bonds over cash. In this month’s issue, we illustrate the potential consequences –and more acutely theoretical financial impact– of not staying invested.

Outlook

With the Federal Reserve potentially nearing the conclusion of its hiking cycle and inflation showing signs of moderation, we advocate for a thoughtful reallocation of portfolio allocations in preparation for the upcoming year. Recognizing the persistent presence of risks and acknowledging the futility of market timing, we encourage clients and readers to stay tuned for our 2024 Outlook in December. This forthcoming report will delve into key themes and provide insights into our positioning for the next year and beyond.

Disclosures & Definitions

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

- Bloomberg US Government/Credit Long Index is the Long component of the U.S. Government/Credit Index, which includes securities in the Government and Credit Indices. The Government Index includes treasuries and agencies, while the credit index includes publicly issued U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements.

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impact by currency and/or country specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrow.

Download our 2025 Financial Planning Guide