Many retirees find southern states quite attractive because of the warmer weather, lower cost of living and the ability to enjoy outdoor activities nearly year-round. Buying a new home to escape the winter weather becomes even more enticing when it also provides attractive income and estate tax benefits. However, you should know that your former state may not let you go without a fight.

The Determination of State of Residence

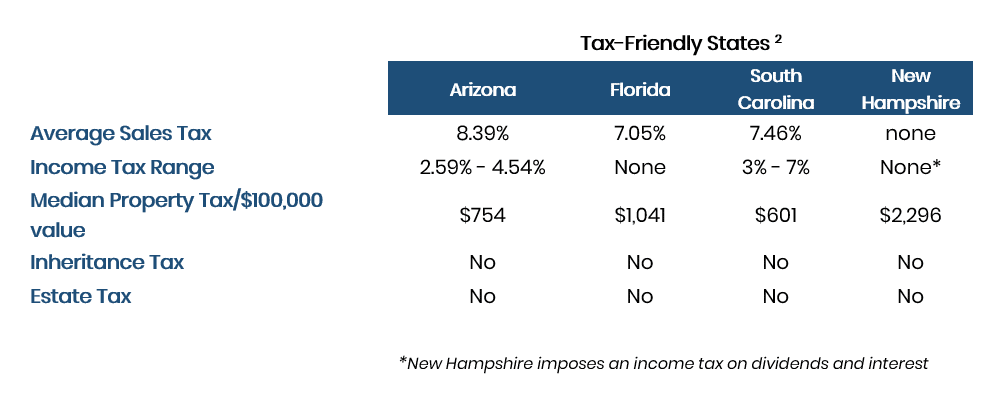

With significant differences in the application of income, inheritance and estate taxes across states, the determination of domicile has become a significant financial consideration for many individuals. As more and more Baby Boomers enter retirement, the exodus from high-cost jurisdictions is increasing, particularly following the 2017 Tax Cuts and Jobs Act (TCJA).

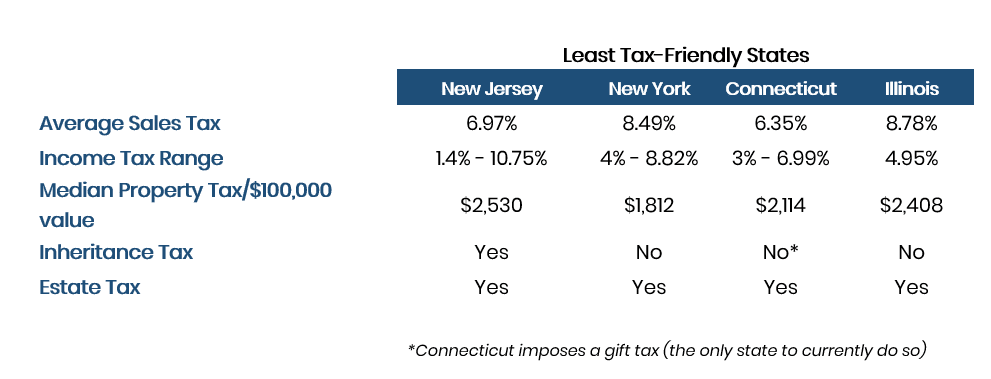

In 2019, New Jersey led the movement outbound with 37% of its population leaving, followed closely by Illinois (33%), New York (26.2%) and Connecticut (26%).1 These states topped the list of jurisdictions with dwindling populations and dwindling tax revenues. It comes as no surprise then that states are directing increased resources to investigate whether their residents are truly leaving the state or just trying to escape higher taxes.

State Residency and Domicile Are Not the Same

Residency can be established by physical presence in a particular jurisdiction while domicile is physical presence coupled with intent to make it your permanent home. An individual may have more than one residency, but only one domicile.

Spending significant time in a state does not establish domicile; you must also prove that you intend to make it your true permanent home. The best indicator of your intention is reflected by your actions and where you handle your affairs. If you sell your home and do not return to your old domicile, your intent is clear.

For most individuals, however, an abrupt severing of ties isn’t always possible. If you maintain a home, regularly visit or maintain business and family connections in your old domicile, proving your intent to change domicile may rely more on subjective factors. And, the burden of proving your intent to change domicile in an audit situation is on you as the taxpayer.

Subjective Factors in Residence Determination During a Tax Audit

During a state tax audit, there are many subjective factors which may be considered in establishing or disproving intent. Each is considered independently and weighed against the totality of circumstances. For example, if you maintain a residence in the prior domicile, is it more significant in size or associated expenditures? A new home which is less significant, coupled with maintaining your personal effects (personal items, art and pets) at the original home, may make it more difficult to prove the new location is your intended permanent domicile. Leasing your prior home or disconnecting the utilities during the “off-season” may support your domicile claim.

Other subjective factors include:

- Where are your medical and financial as well as sentimental records stored?

- Where are your doctors and advisors located?

- Are you more active socially in the new state with boards and club memberships?

- Have you severed ties or changed membership status with organizations in your prior domicile?

- Do you celebrate holidays in the old or the new state?

While an examination of these factors may seem intrusive, they can be helpful in articulating intent.

Records are Essential

Tracking and documenting time in and out of your prior domicile is important, but not foolproof. Many states, including New York, New Jersey and Connecticut, consider 183 days the minimum amount of days absent for non-resident status. And all days in the jurisdiction count, regardless of purpose – even family holidays, celebrations and dinner gatherings with friends. Keeping a diary or calendar of all touchpoints with your current and former domicile is important, particularly in the first couple of years. Credit card activity, E-Z pass use, cell phone records and plane tickets are all accessible during an audit.

While objective factors may not be as helpful in proving your intent, failure to follow through with the basic residency requirements can derail your domicile claim. Once physical presence is established, it is important to file a Declaration of Domicile in the new state (if applicable), file for Homestead status (if applicable), register to vote, obtain a driver license and register any vehicles/boats to be used in that state.

Prior tax filings and exemptions can cause problems if you don’t change state filing status to non-resident or fail to deactivate resident benefits (such as Homestead election) in your prior state. These administrative details can play an important role in supporting your domicile claim.

Estate Plan Considerations

Revisiting your estate plan is critical to ensure advance directives comply with local law and that all provisions of wills and trusts are enforceable in your new domicile. With many of the tax-friendly jurisdictions also providing favorable trust code and asset protection status to estates and trusts, it is important to review all estate planning documents to coordinate and preserve these favorable terms and protections.

Be Aware of Double Taxation

While you may be successful in declaring a new domicile, it does not mean you are exempt from taxes in your former domicile now or in the future, particularly if you maintain business interests, employment, real estate or spend substantial time in the former jurisdiction.

Income sourced from your prior domicile may retain its taxability. Some states, including New York and New Jersey, can consider an individual a statutory resident if they maintain a home or apartment (owned or leased) within the state and spend more than 183 days in the state in any year, regardless of their declared domicile. This can become an issue if an individual domiciled elsewhere is present in the state for an extended period due to illness or unforeseen circumstances. Since rules for residency and taxation change, periodic review is essential to avoid unintentional multi-state taxation.

Before moving for better weather and significant income and estate tax benefits, proper planning and understanding the rules are critical to avoid unintended consequences.

If you have questions about this topic or would like more information, please call us directly at 770-368-9919 or email Cliff, [email protected] or Kevin, [email protected].

1 Annual 2019 United Van Lines National Movers Study

2 Kiplinger State-By-State Guide to Taxes

Download our 2025 Financial Planning Guide