Estate planning is critical to protecting your life’s legacy. Without it, those next in line face unnecessary challenges in receiving what’s rightfully theirs.

But the type of planning you, and your beneficiaries need will depend on the complexities of your estate. For those looking to leave larger amounts behind, or who have assets that could appreciate significantly, it may be worth looking into a grantor retained annuity trust (GRAT).

In this article you’re going to learn what a grantor retained annuity trust is, who it is right for, how it works, and how you can take action in creating one for yourself.

Table of Contents

What Is a Grantor Retained Annuity Trust (GRAT)?

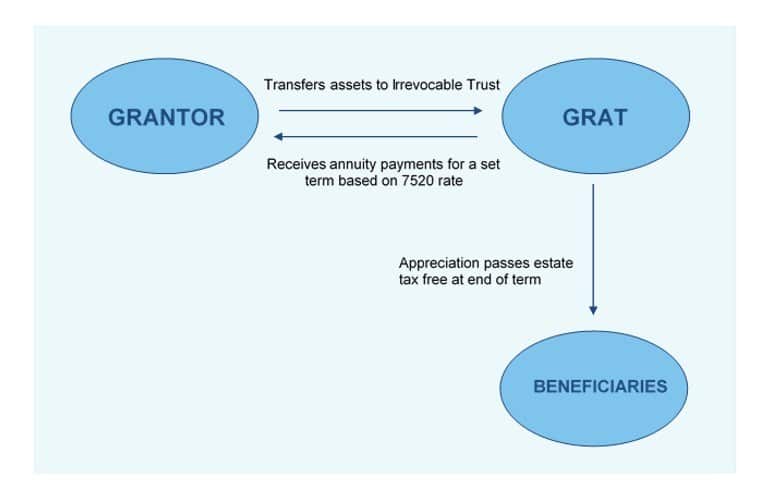

A grantor retained annuity trust (GRAT) is a key strategy used in transferring the wealth of potentially highly-appreciable assets. It is a type of irrevocable living trust that establishes an annuity payment to the trust’s creator (known as the grantor) that’s typically equal to the assets placed inside it.

By using a GRAT, you’re essentially able to freeze your assets at their present value. That value is then returned to your estate through annuity payments over a specified time period. However, any appreciation earned on your assets while inside the GRAT can be transferred to your designated beneficiaries with no gift taxes.

Who’s Right For A GRAT?

The federal gift and estate tax exemption allows for a certain amount of assets to be given to beneficiaries without being subject to estate and gift taxes. But after this amount is surpassed, severe estate taxes (as high as 40%) can start impacting the wealth you’re transferring.

This exemption amount is adjusted for inflation each year. And for 2023, the IRS has raised the exemption to $12,920,000 for individuals, and $25,840,000 for married couples.

As a result, GRATs are typically best for wealthier individuals and families whose assets exceed the federal gift and estate tax exemption limits. However, they may also be appropriate for those who believe their asset(s) will appreciate exponentially over time (ex: a startup company).

Please Note: Presently, the Tax Cuts and Jobs Act is set to expire at the end of 2025. As a result, starting in 2026, the federal gift and estate tax exemption will be returning to its pre-2018 level ($5,000,000 for individuals) with adjustments for inflation. So unless legislation changes, GRATs may become viable for individuals and families at a much lower wealth level.

How Does A Grantor Retained Annuity Trust Work (GRAT)?

Process Overview

Step 1: A grantor establishes a GRAT by transferring assets (commonly ones expected to appreciate the most) into an irrevocable trust for a specified period of time.

Step 2: The GRAT’s value is then derived from IRS actuarial tables, and is divided into an annuity stream of income and remainder interest. Typically, the annuity is then structured to payout the value of assets initially transferred into the GRAT to “zero out” the trust. And all (potential) appreciation on assets is set to be passed on to the designated beneficiaries.

Step 3: The grantor receives the annuity’s income over the specified time period. During this time, the GRAT must meet a minimum interest rate (i.e. the hurdle rate) that’s set by IRS Section 7520 every month. Should this not happen, the GRAT dissolves, uses its principal to cover remaining annuity payments, and transfers all its assets back to the grantor.

Step 4: After the hurdle rate is met (or surpassed), and all annuity payments have been made to the grantor, all appreciation in asset value(s) can be distributed to the grantor’s designated beneficiaries free of gift taxes.

Selecting A Time Frame

How Long Does a GRAT Last?

GRATs are established within specified time frames (usually 2 to 10 years), and they must exceed the IRS hurdle rate within that time. For this reason, it may make sense to use a single, long-term GRAT to give your assets more time to meet the minimum appreciation requirement.

Rolling GRATs

However, you can also use what’s known as a rolling GRAT. A rolling GRAT is a series of short-term GRATs where annuity payments rollover into subsequent trusts rather than returning to the grantor. The grantor then receives larger annuity payments in the final years of the rolling GRAT’s cumulative time frame.

Which Time Frame is Right for You?

The time frame you’ll want for your GRAT will largely depend on how you anticipate your assets will appreciate. For more volatile assets (ex: stocks), a rolling GRAT may make more sense. That’s because a new GRAT is created each time, which may allow for assets to appreciate greatly from the bottom of a dip in the market.

But with less volatile assets (ex: real estate), one longer-term GRAT may be the better option. With this, you’re able to lock in a single hurdle rate for the duration of your trust. And you’ll save yourself the additional administrative costs of setting up multiple GRATs.

Funding Your GRAT

The easiest way to fund GRATs is with liquid, investable assets (ex: publicly-traded equities) you believe will appreciate over time. This is because their value is easily determined when being invested, and transferred to your beneficiaries.

That said, GRATs can also be funded with more complicated assets (ex: shares of a family business). However, deriving the value of such assets can entail lengthy, and costly processes such as appraisals.

Using Multiple GRATs

Depending on your situation, you may want to put an assortment of asset types inside a GRAT. If that’s the case, it may make sense to use multiple GRATs that separate the assets by classification.

For example, you may want to use one GRAT to house your simpler, liquid assets. And another to house your more complicated assets.

By diversifying your GRATs by asset type, you can help protect their overall success. That’s because if asset types are combined, and one depreciates in value, it can drag the entire performance beneath the hurdle rate. And this will cause your GRAT to fail.

Substituting Assets In Your GRAT

After your GRAT is funded, it’s possible to substitute assets inside of it with ones outside of it. To do this, the grantor (i.e. you) can also be named as the trustee. Another option is to have the attorney who creates the trust include specific language that allows for this ability.

This flexibility is useful for a variety of reasons. If your assets are underperforming, you can replace them with ones more likely to appreciate. And if they appreciate quickly, you can lock in the increases in value by substituting them with assets subject to lower volatility for the duration of the GRAT term.

The ability to substitute assets also comes in handy should you need liquid assets unexpectedly. For example, you can swap out cash in your GRAT with similarly-valued, less-liquid assets. But keep in mind that doing so may again entail processes like appraisals.

Receiving Your GRAT Annuity Payments

It’s also imperative that the annuity payments of your GRAT are made properly. That means they’re valued correctly, and are paid on time.

If your annuity income is incorrectly valued or paid off-schedule, the consequences can be severe. Such payments could be treated as additional grantor contributions, which would disqualify your GRAT and its tax-friendly abilities.

As a result, the trustee (which can be an attorney) needs to keep accurate records of the GRAT. This includes the GRAT’s appraisals, valuations, and account statements.

Fixed Or Increasing Income Streams

When structuring the annuity portion of the GRAT, the grantor has the ability to receive cash or a portion of the GRAT’s assets. Additionally, the grantor can decide on a fixed series of payments or a variable series that rises each year.

With a fixed stream of income, your GRAT’s annuity will pay the same amount on a scheduled interval (at least yearly) for the duration of the trust. But with increasing streams of income, your payments can rise up to 20% each year.

With increasing payments, you’ll receive lower payments at the start of your GRAT’s term and higher ones towards the end. As a result, there’s a greater portion of your assets that can potentially appreciate during the initial stages of your GRAT.

How Are GRATs Taxed?

Gift and Estate Taxes

Technically speaking, you make a gift with the creation of a GRAT. So an immediate gift tax may be due from the grantor. The amount (potentially) owed is determined by subtracting the grantor’s retained annuity interest from the fair market value of all assets inside the trust. If anything is left over, it’s considered remainder interest, and it’s subject to gift taxes before passing on to beneficiaries.

Here’s an example:

You place $2,000,000 of assets inside a 5-year GRAT with fixed, annual annuity payments of $300,000. Your Grat’s Section 7520 rate is 2.5%, which leaves you with $1,393,748 of retained interest, and $606,252 of remainder interest. Put another way, the right to receive your annuity income is worth $1,393,748, and the right to give your beneficiaries what remains is worth $606,252. As a result, gift taxes are owed on the value of the remainder interest.

It should be noted that your federal estate and gift tax exemption can be applied to remainder interest. It’s also possible to have your retained interest equivalent to the fair market value of the assets in your trust. This is a common strategy that “zeros out” your GRAT, and leaves no remainder interest for the grantor to pay gift taxes on (see process overview step 2 above).

Income Taxes:

As the grantor, you’ll need to report all income, gains, and losses of your GRAT on your personal income tax return. This effectively allows more wealth to be transferred because neither your beneficiaries nor your trust are responsible for the payments. On top of this, the IRS has determined that when the grantor pays the income taxes, there’s no additional gifts being contributed to the GRAT.

Capital Gains Taxes

Gifted assets, keep the same cost basis that you hold in them. That means if your beneficiaries ever sell the assets you give them, they’ll have to pay capital gains taxes on all gains associated with the asset- not just the ones they experienced from the time they got them.

As a result, your beneficiaries may need to pay significant income taxes should they sell what’s given to them from your GRAT. That said, the federal long-term capital gains tax rate maxes out at 20%. So compared to the potential 40% estate tax, they can still end up with far more through a GRAT.

Overall Benefits Grantor Retained Annuity Trust (GRAT)?

Minimal Use of Tax Exemptions – By using a GRAT, it’s possible to minimize the use of your lifetime federal gift and estate tax exemption.

Flexibility of Asset Distribution – After the GRAT period ends, grantors have the option of having the assets distributed immediately to the designated beneficiaries. However, they can also have the trust retain the assets for a number of years even after the grantor’s death.

Transferring Appreciation – If you’ve already maxed out your lifetime federal gift and estate tax exemption, you can use a GRAT to transfer more wealth (in the form of appreciation) to your beneficiaries without them facing gift taxes.

Substitution of Assets – If structured properly, you’re able to have the flexibility of substituting assets inside your GRAT for ones outside of it. This allows you to lock in gains, hedge against underperforming assets.

Flexibility of Annuity Payments – You have the ability to change how you receive the annuity payments of your GRAT. You can receive your income in fixed amounts, or along an increasing schedule that leaves more of your assets able to appreciate in the beginning of your GRAT’s term.

Highly-Appreciable Assets – Whether you have high-value assets or ones with the potential to rise significantly in value, a GRAT can be used to transfer large amounts of appreciation gift-tax-free to your beneficiaries.

Disadvantages of Using a Grantor Retained Annuity Trust (GRAT)?

Mortality Risk – If the grantor dies before the end of a GRAT’s term, all assets return to the grantor’s estate, and will be counted when calculating estate taxes. This risk can be mitigated by electing a shorter-term GRAT, or using a rolling GRAT strategy as only the assets in an active GRAT are returned to the grantor’s estate upon death.

Administrative Fees – Setting up a GRAT (or multiple GRATs) can involve ongoing costs for attorney, tax, and financial advice as well as valuation services like appraisals.

Capital Gains Tax – Depending on the circumstances, if your beneficiaries sell the assets distributed to them, they may have to pay the full amount of capital gains tax associated with the grantor’s initial cost basis.

Future Legislation Concerns – Over the years, there have been legislative attempts to curb the abilities of GRATs to transfer wealth. These have included, but are not limited to, mandatory longer terms and remainder interest greater than zero.

Minimum Interest Requirements – GRATs must meet their hurdle rate. If they do not, the trust dissolves, its principal covers the remaining annuity payments, and all assets return to the grantor’s estate.

Generation-Skipping Transfer Tax – GRATs are not able to lessen or avoid the generation-skipping transfer tax (GSTT). As a result, if you’re transferring wealth to individuals like grandchildren, a GRAT may no longer be the most viable option.

How CW O’Conner Can Help

At CW O’Conner it’s a privilege to help our clients keep their legacies in tact. And the primary way we’re able to help is ensuring you have the right estate plan in place.

Depending on the size of your estate, or the appreciability of your assets, it may be worth looking into a Grantor Retained Annuity Trust. They’re a powerful vehicle in transferring the appreciation of your wealth to those next in line.

As a team, we’ll help figure out the term length, assets, and income streams that make up the GRAT that’s right for you. We’re able to work with your attorney. But we’re also able to recommend one of our own. Either way, we’ll help with the setting up, and record keeping needs of your trust.

If you’re ready to establish a GRAT, or have further questions on whether or not one may be right for you, please don’t hesitate to reach out. You can call us directly at 770-368-9919, or you can fill out a contact card, and we’ll reach out to you.

Download our 2023 Financial Planning Guide